Clubs on Campus 2025 | Sem 2 Week 12

Check out these 5 cool clubs at Waipapa Taumata Rau | University of Auckland!

Check out these 5 cool clubs at Waipapa Taumata Rau | University of Auckland!

A review of BIBI's first world tour: EVE. Read about her versatility in shapeshifting personas - from EVE: chaotically charming to EVE-1: explosive, impulsive, and determined to claim her own identity.

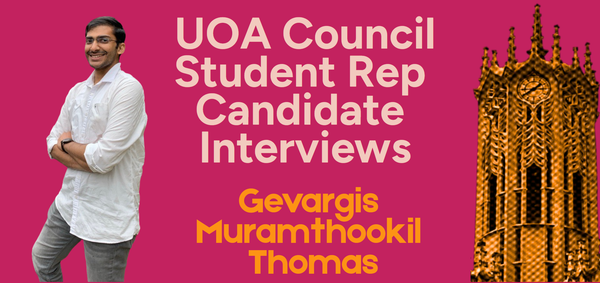

Interview with Gevargis Thomas | Vote now in the University Council Student Rep Elections!

Interview with Matthew Prance | Vote now in the University Council Student Rep Elections!

Interview with Shriya Kelderman | Vote now in the University Council Student Rep Elections!

Interview with Shakeel Shamaail | Vote now in the University Council Student Rep Elections!

Interview with Shae Hardy | Vote now in the University Council Student Rep Elections!

Interview with Steven Harrison | Vote now in the University Council Student Rep Elections!

Interview with Adnan Shahab | Vote now in the University Council Student Rep Elections!

Interview with Angela Fang | Vote now in the University Council Student Rep Elections!

Check out these 5 cool clubs at Waipapa Taumata Rau | University of Auckland!

On this weeks edition of Irene Eats, the katsu chicken meal from The Bowl was the star of the show.